Homeowner loans made simple

Find the best homeowner loan now.

Free property valuation, No upfront fees

Quick Links

Homeowner Loans for any purpose

Whether you’re dreaming of decorating, considering consolidating or have loftier dreams like an attic conversion, a homeowner loan might be perfect for you.

Not only do homeowner loans usually let you borrow more money than a personal loan, but you’re also likely to get offered better rates too. That’s because you’re using your home as collateral, making the lender see you as a much safer bet for larger amounts of money.

Low-cost Homeowner Loans

✓ From £10,000 to 1.5 million

✓ Free property valuation

✓ No upfront fees or hidden charges

✓ High loan to value available

✓ Free, no-obligation quote

✓ Loan.co.uk has won multiple awards

” I absolutely cannot speak highly enough of loan.co.uk. Wouldn’t hesitate to recommend this company to anyone. I’m delighted! “

—

” Couldn’t help me enough and I thank you from the bottom of my heart for all your help “

Verified clients @ reviews.co.uk

As featured in

Want to get an idea of how much you could borrow with a homeowner loan?

Get a quick idea of how much you could borrow and what your repayments might look like in a few seconds with our homeowner loan calculator.

Is a homeowner loan right for you?

Homeowner loans don’t need to be complicated. Discover how to use your home to borrow the money you need, then find the best deal for you with our super-smart tech.

If you want to borrow bigger chunks of money or want to spread your repayments out over a longer period of time, a homeowner loan might be the right choice for you. However, you will use your house as collateral, so it’s a good idea to consider all your options.

A homeowner loan might be a good fit if…

You want to borrow between £10,000 and £10 million.

You own a house but have a less-than-perfect credit rating.

You want to take longer to pay off your loan.

You want to consolidate lots of debt into affordable repayments.

Everything you need to know before applying for a homeowner loan

How does it work?

You’ll need to be a homeowner. Pretty obvious, right? To get a homeowner loan you need to, well, own a home.

Also known as home equity loans, homeowner loans let you borrow a lump sum of money that is “secured” against your property.

As a result, the lender is usually happier to lend you more money, offer you better rates or extend the repayment schedule to make things easier for you.

How much can you borrow?

With a homeowner loan, you can borrow between £10,000 and £10 million. However, the amount you will be able to borrow will be based on how much of your house you own outright.

To get a rough idea of the most you might be able to borrow, find out how much of your mortgage you have left to pay off and take this away from how much your house is worth right now.

Will you be approved?

Just like with any other loan, your lender will want to look at your credit history and credit score. However, because you’re putting your house up as collateral, they’ll be more interested in your personal circumstances, the value of your property, and mortgage details.

As such, you’re more likely to be able to borrow the money you need with a homeowner loan than a personal loan.

(Our homeowner loan calculator can help you get an idea of what deals you’ll qualify for.)

You can pay it off over longer

Unlike personal loans, homeowner loans let you borrow the money you need for up to 35 years.

This lets you spread the cost out into manageable monthly repayments.

(Of course, if you find yourself flush with cash, you can pay it all off early too.)

“They worked tirelessly to get us the best deal”

4.9/5 Rating | Over 2,000 5-star ratings at Reviews.co.uk

Sinead Hennebry

“It was a pleasure to deal with Loan.co.uk for the loan for our home improvements. The team were amazing, they worked tirelessly to get us the best deal, were always available for any queries and were so efficient, friendly and made the process seamless. Even when there were issues, they went above and beyond to find solutions to ensure we were able to get the most competitive loan in the market. I would definitely recommend Loan.co.uk to anyone looking for a loan.”

VERIFIED REVIEW

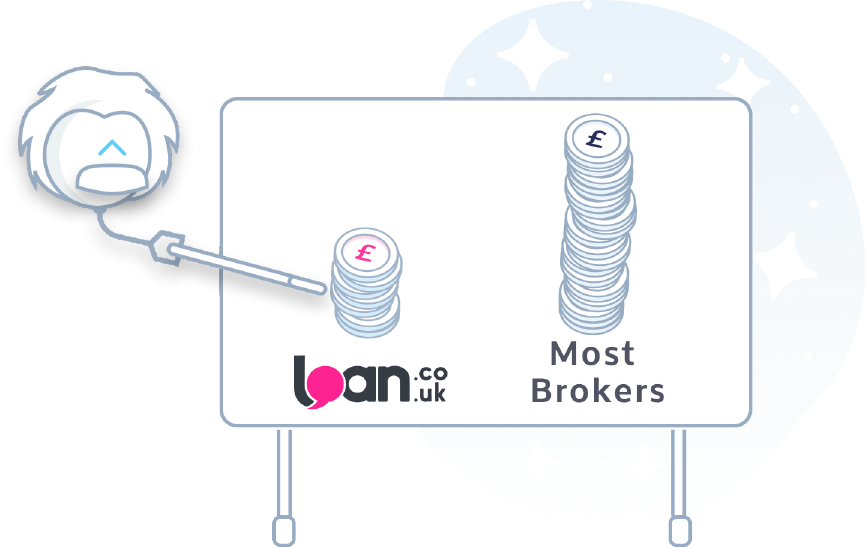

Be Smart !

Don’t pay high homeowner loan fees

Loan.co.uk have up to 50% lower fees than other brokers (see below).

A homeowner loan broker you can trust

Always get the best secured loan available to you

Loans are available even if you have an adverse credit score

Learn more about homeowner loans

Financing home improvements: homeowner loan or remortgage?

Ultimate guide to home improvement loans

Difference between secured loan and unsecured loan

Representative Example for secured loans & Second Charge Mortgages: If you borrow £18,000 over 10 years, initially on a fixed rate for 5 years at 7.4% and for the remaining 5 years on the Lender's standard variable rate of 7.9%, you would make 60 monthly payments of £249.27 and 60 monthly payments of £254.63. The total amount of credit is £19,657 (this includes a Lender Fee of £595 and a Broker Fee of £1,062). The total repayable would be £30,234.00. The overall cost for comparison is 10.42% APRC representative. This means 51% or more of our clients receives this rate or better for this type of product. We have arranged borrowing with rates from 4.9% to 29% APRC which has allowed us to help customers with a range of credit profiles. We are a broker not a lender.

Secured Loans have a minimum term of 36 months to a maximum term of 360 months. Maximum APRC charged 29%. If you are thinking of consolidating existing borrowing you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.